Top Takeaways from the CB Insights MoneyTree report on Q4 2018

PWC and CB Insights launched their Q4 2018 MoneyTree Report earlier this month. Though investors and entrepreneurs alike are buzzing with the newfound energy of 2019, it’s worth taking a look back on what trends shaped Q4 of 2018 and 2018 in venture capital funding globally. Below are some report highlights:

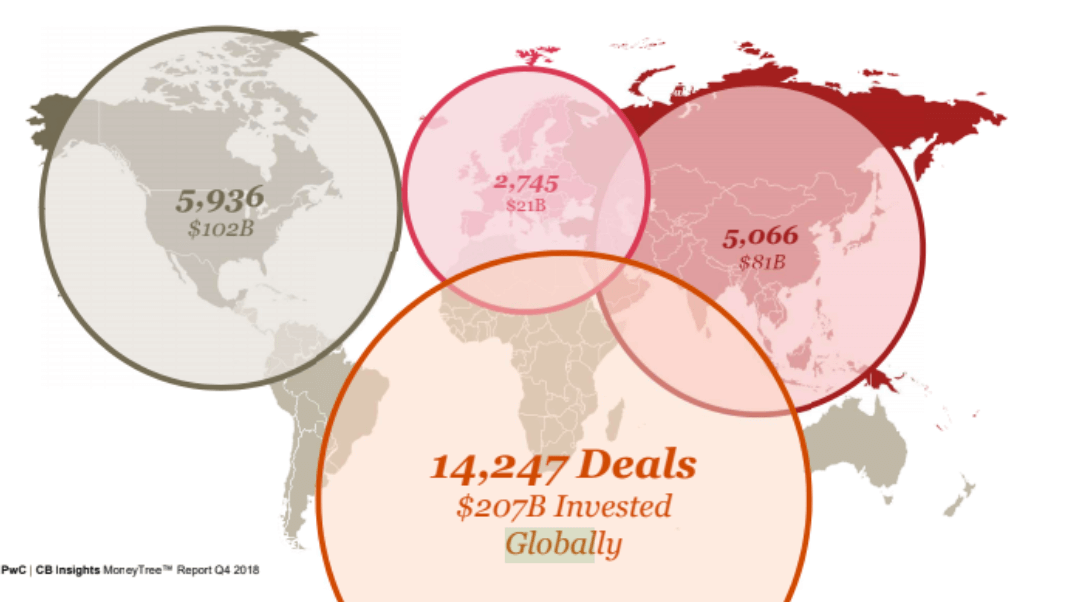

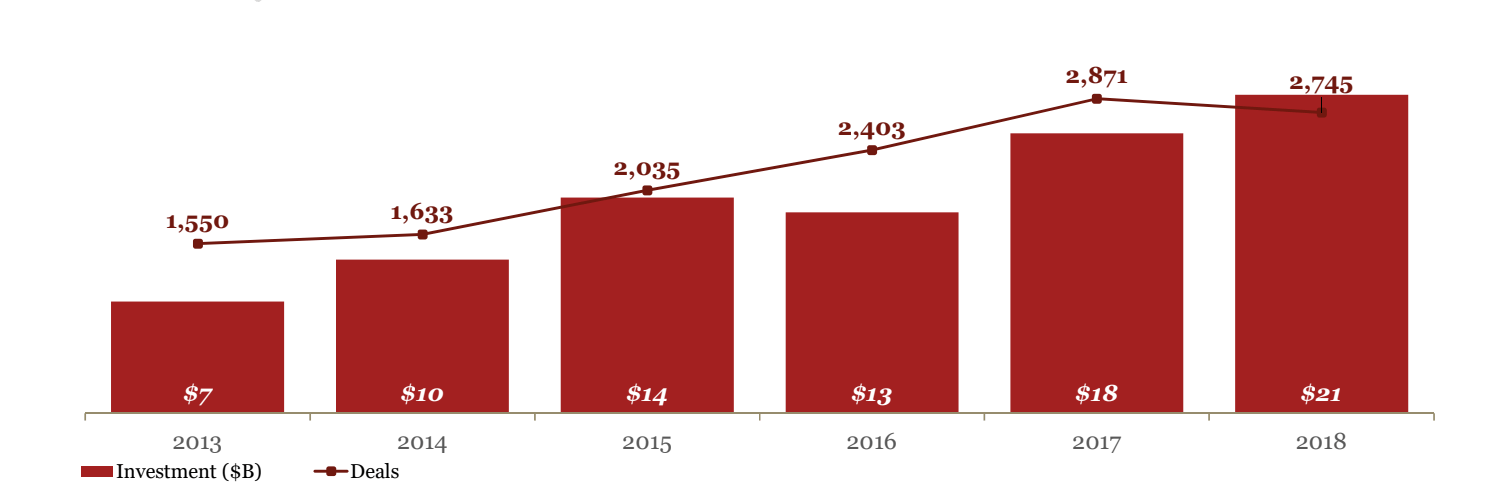

1) 2019 global funding surged 21% compared to funding in 2017, reaching $207B. These were the highest numbers since 2000. Deal activity also rose 10% coming in at 14247 transactions. Within the Alacrity ecosystem, great focused was put on developing our Global Alacrity programs in Wales, France, Turkey, India and Mexico.

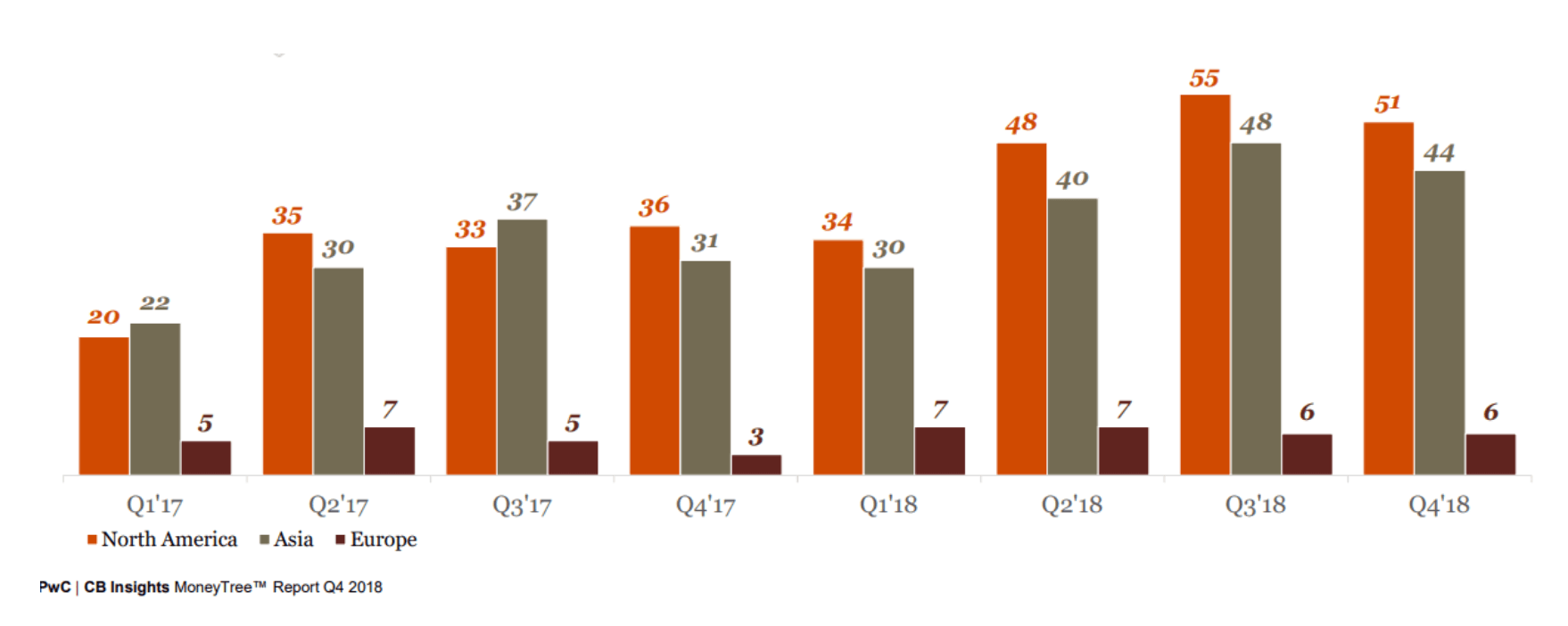

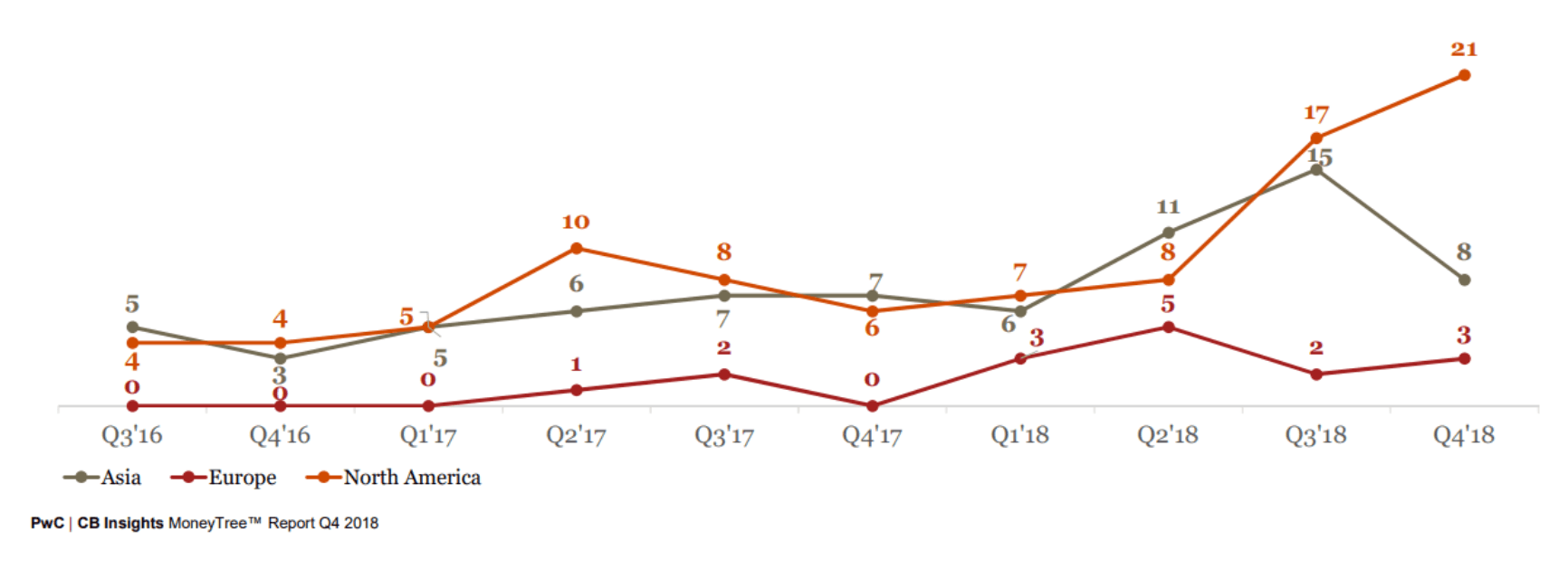

2) North America leads and maintains its position as the continent with the most quarterly $100M+ deals (or ‘megarounds’). It saw 55 megarounds in Q3 and 51 in Q4. Asia came in second with 44 rounds, and Europe third with 6 rounds.

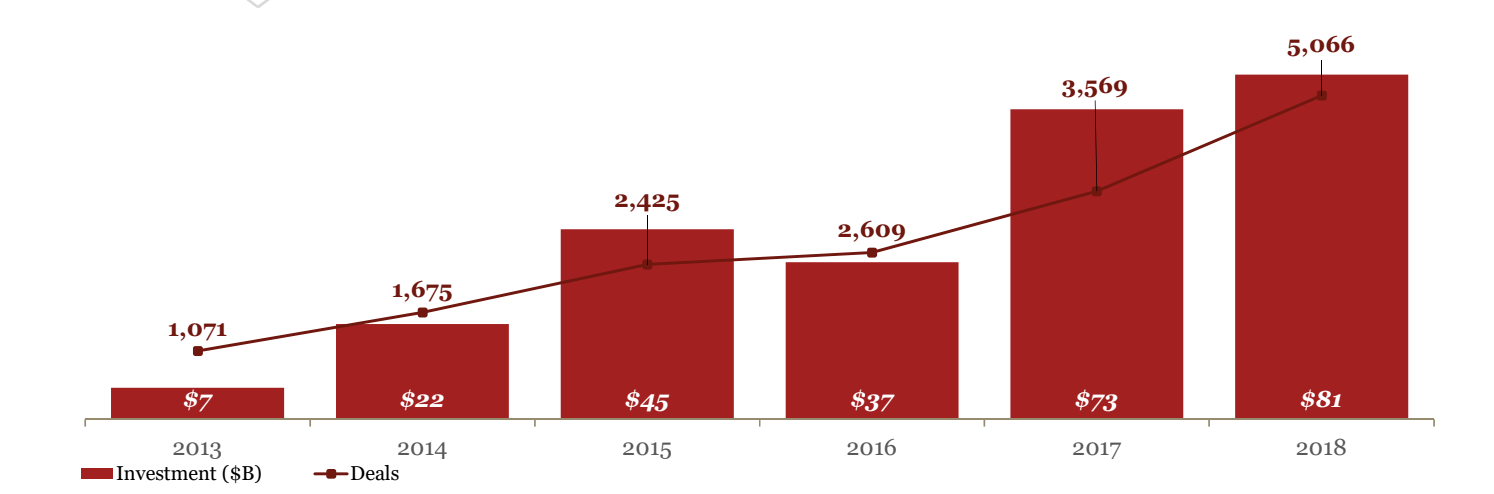

3) Asian funding increases moderately amid surging deal. Asia was an exception to the fall of global deal activity, with 5066 transactions in 2018, a 42% increase compared to 2017. Funding in the region also increased by 11% to $80.9B. Our Alacrity India initiative is well underway, and Alacrity Global is investigating setting up a fund in China.

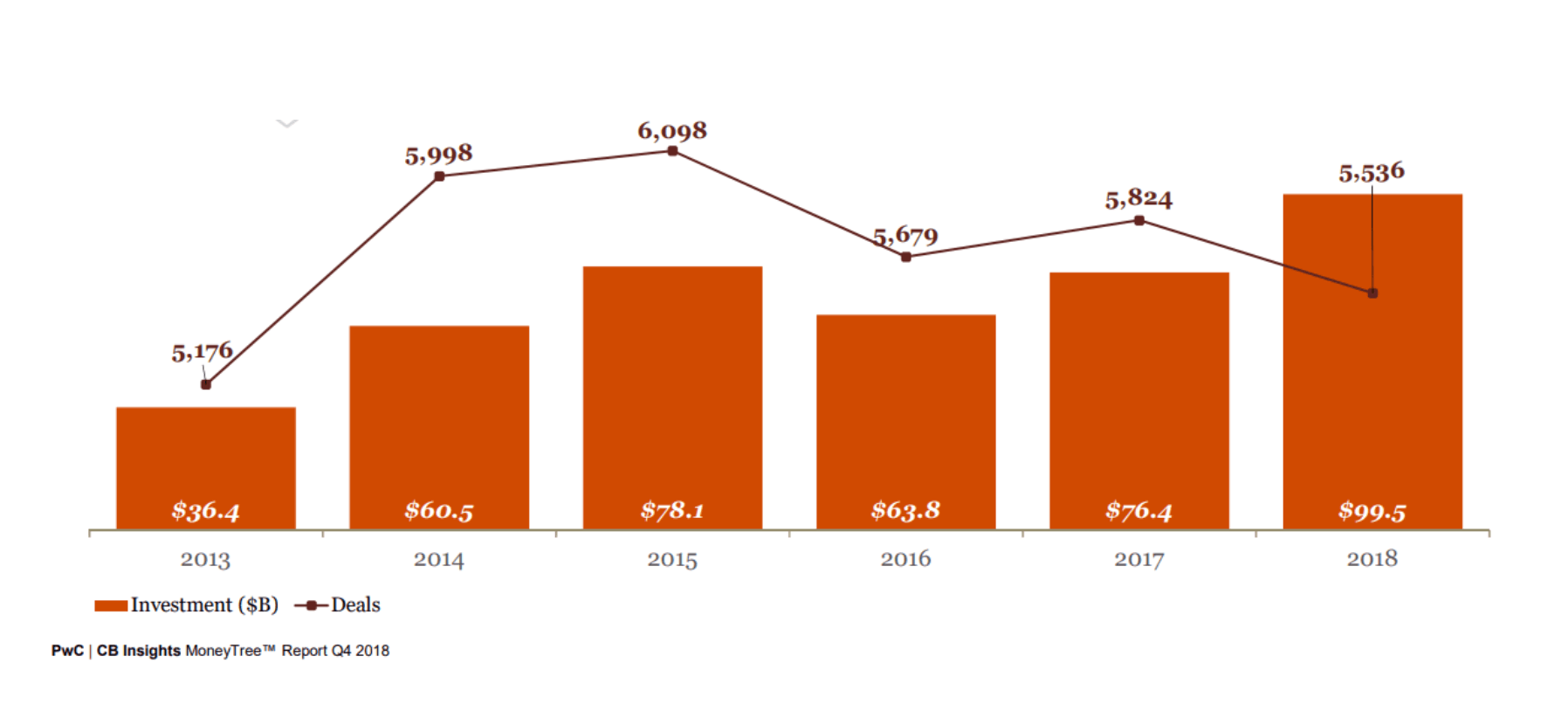

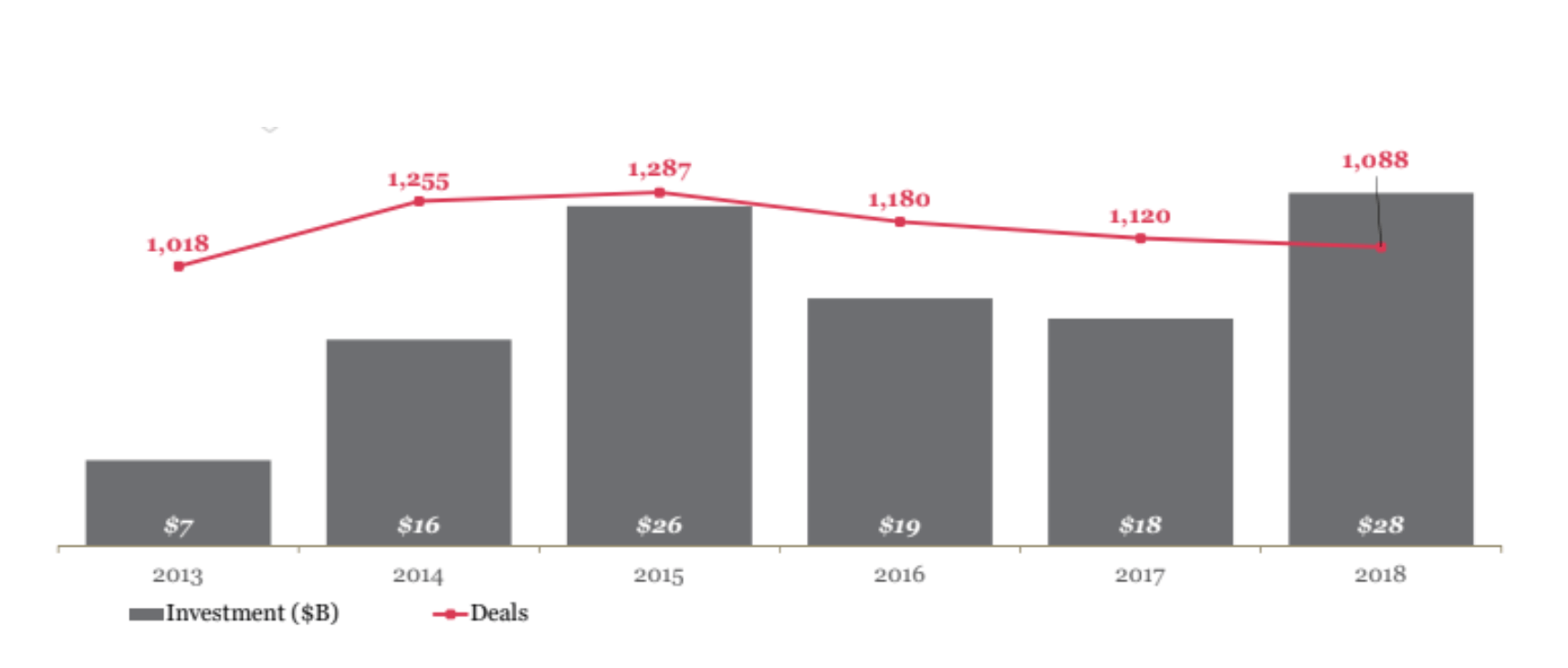

4) The US enjoyed the highest level of venture capital funding since the beginning of the millenium. Though the volume of deals was at its lowest since 2013, funding lept to $99.5B across 5536 deals throughout the year. The number of megarounds drove the funding figure higher and the transaction number lower.

5) Throughout the year 53 US VC-backed companies surpassed the $1B milestone making unicorns (start-ups surpassing a $1.0B valuation) a less rare phenomenon. In Q4 alone North America saw a record 21 private companies hit $1B+ valuations in Q4, surpassing Asia for most new unicorns. In Europe only 3 companies achieved unicorn status in Q4. The west coast of the US dominated four out of five of the largest US deals of 2018. Healthcare software firm Zymergen took the lead as largest deal backed by Data Collective, SoftBank Group, Two Sigma Ventures and True Ventures.

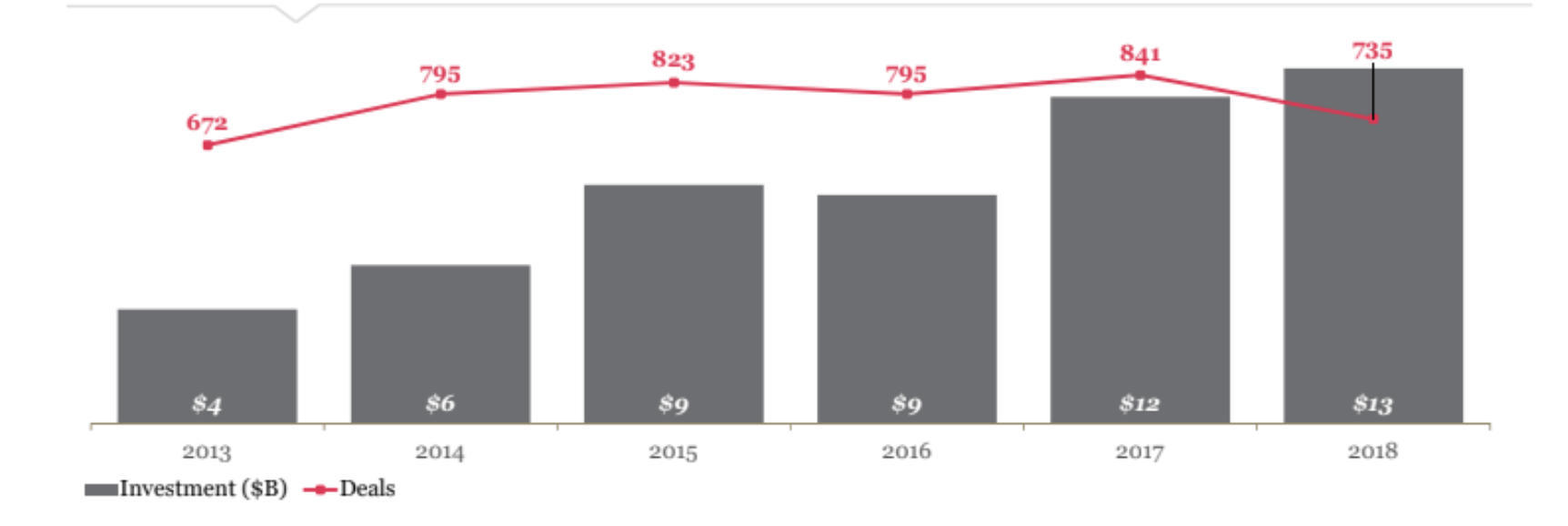

6 ) San Francisco and New York Metro funding set historical records in 2018, reaching $28B and $13B respectively. San Francisco’s funding increased by 55% from 2017, and New York’s by roughly 8%.

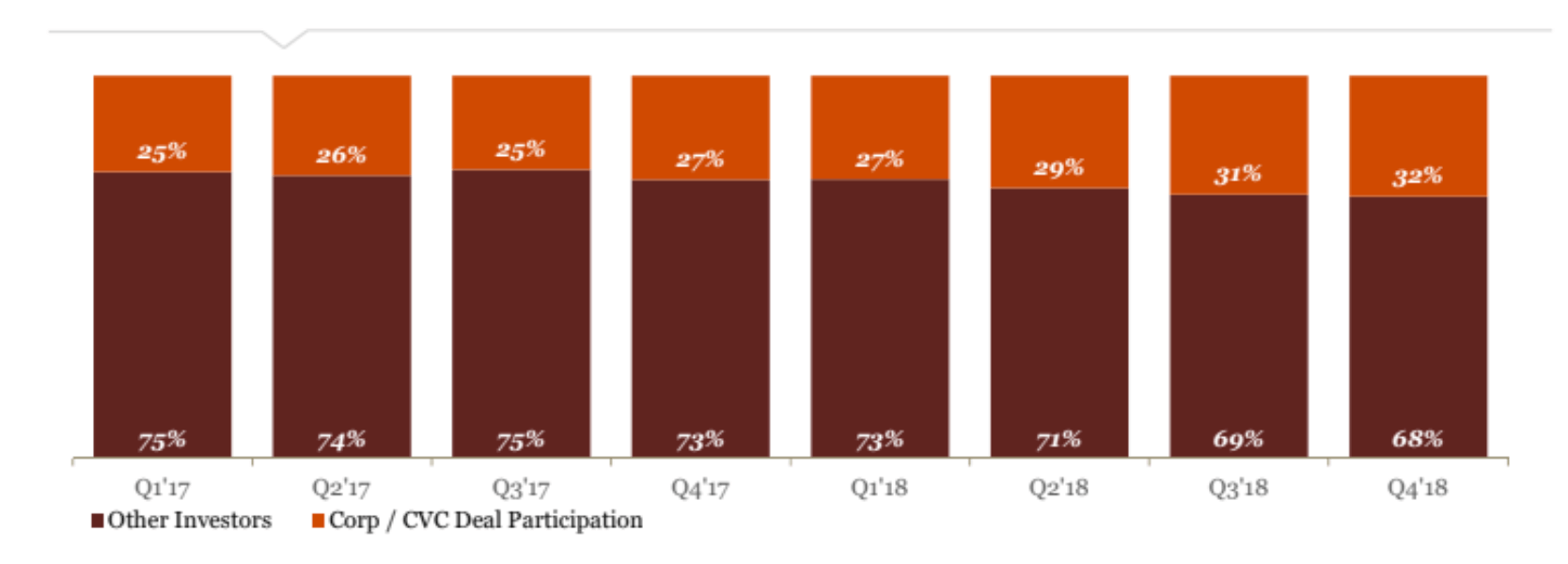

7) Corporate participation has increased 32% globally in the fourth quarter, meaning that corporate investors participated in a third of the VC-backed companies in Q4 ‘18. This trend of corporate participation has mirrored itself in Ottawa, where Blackberry Limited has partnered with L-SPARK, Canada’s largest software-as-a-service accelerator to help small and medium sized technology enterprises.

The trends seen in Q4 2018 set the stage for an exciting 2019. And indeed we are looking forward to all that 2019 brings. The year is already off to a great start. We are pleased to announce that one of the fastest growing companies in our portfolio, Solink, raised $16.3M in series-A funding this January.

What do you think? Will we see more megarounds in 2019? Increased corporate participation? Or a new trend altogether?

Alacrity Global funds and scales technology start-ups around the globe. Our model provides investment, intellectual property, channel and customer opportunities that dramatically improve competitiveness and success rates.